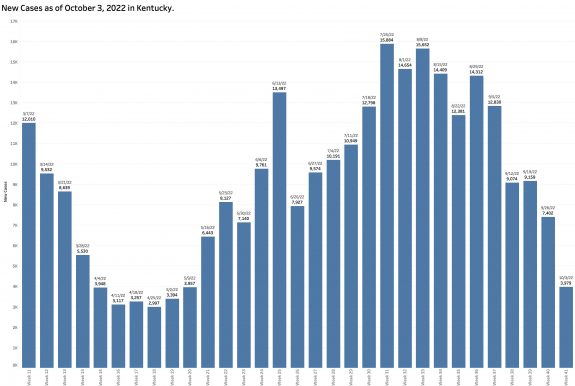

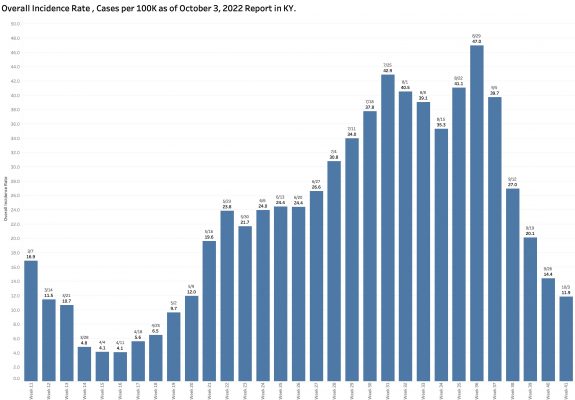

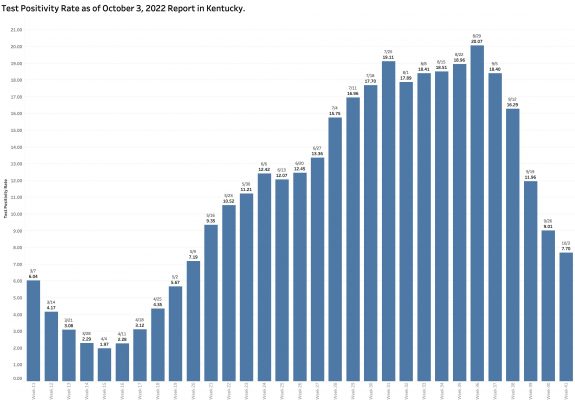

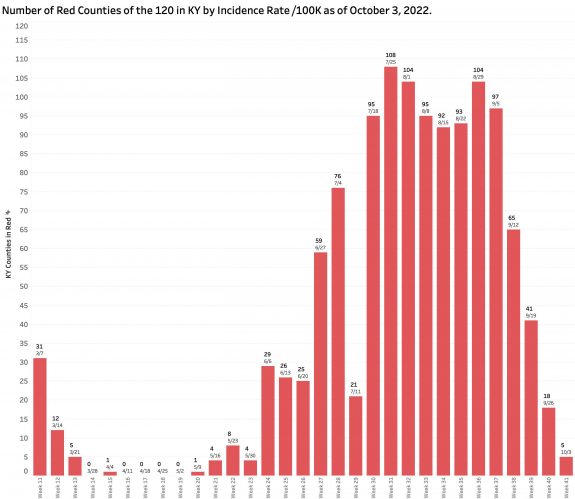

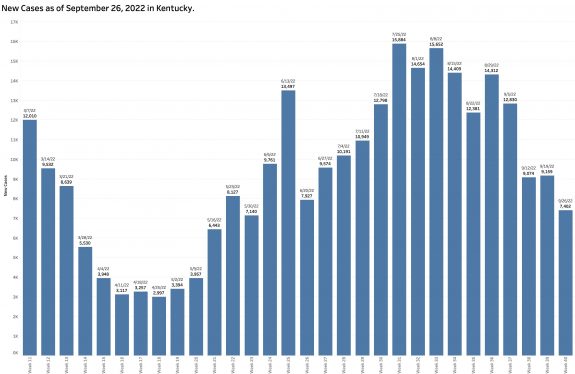

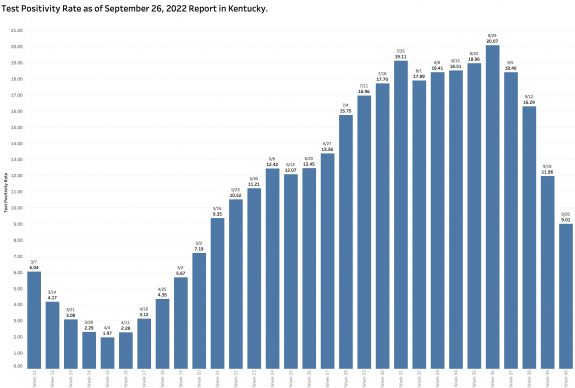

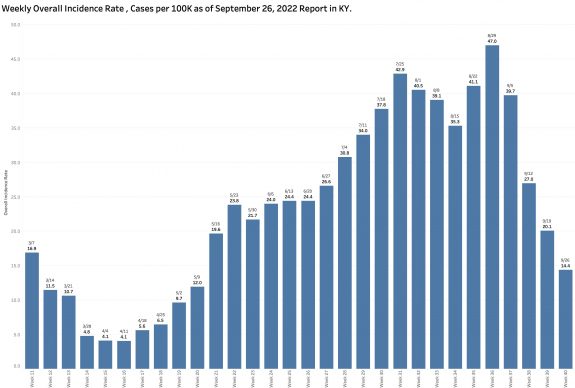

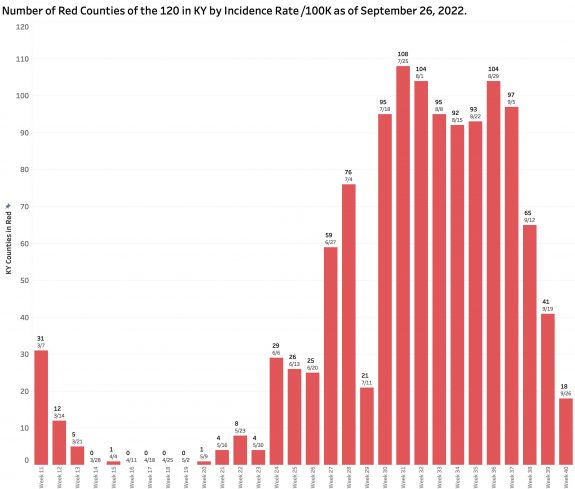

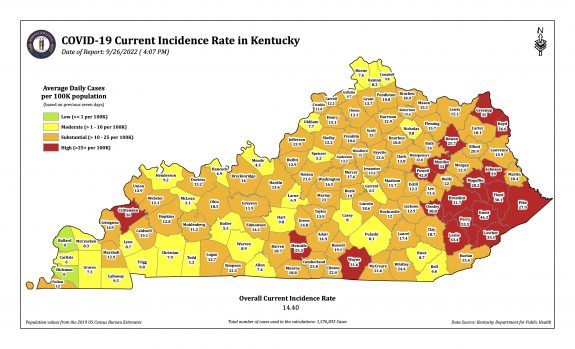

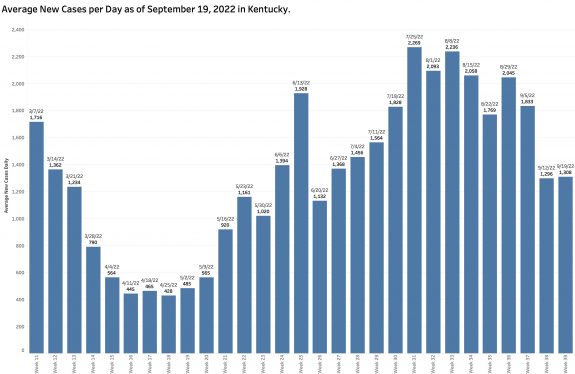

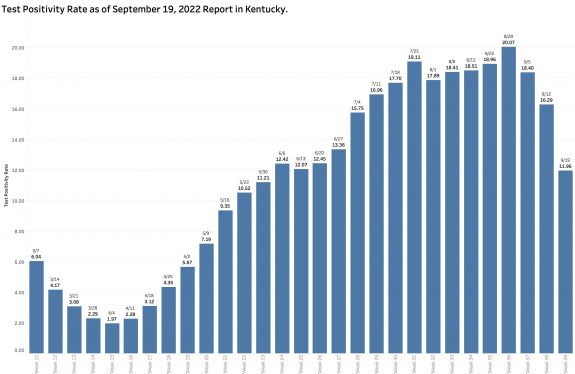

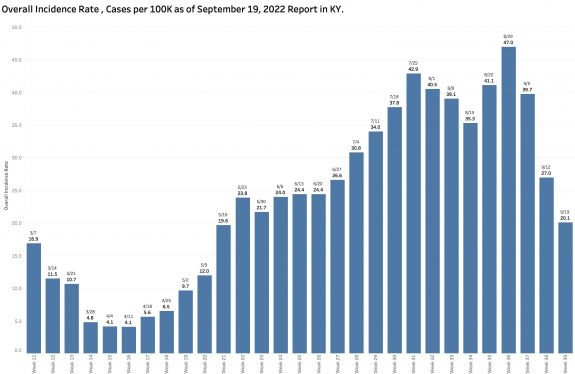

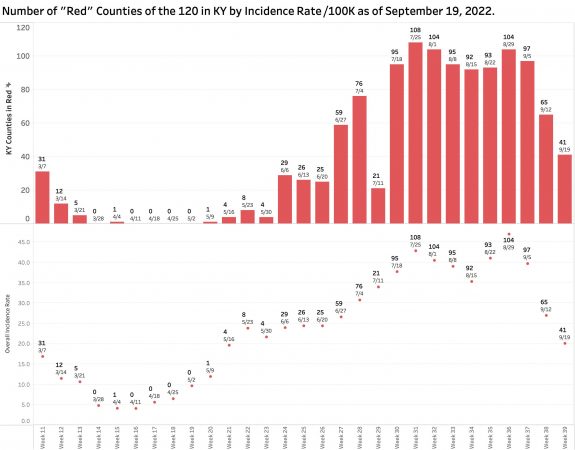

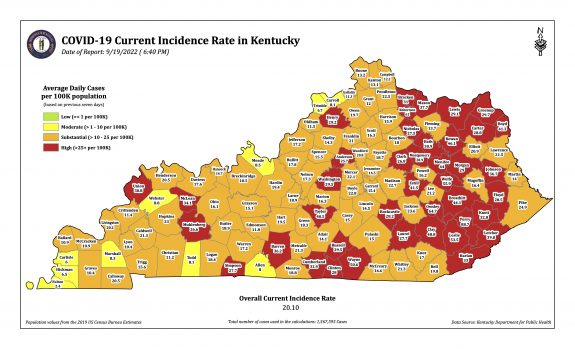

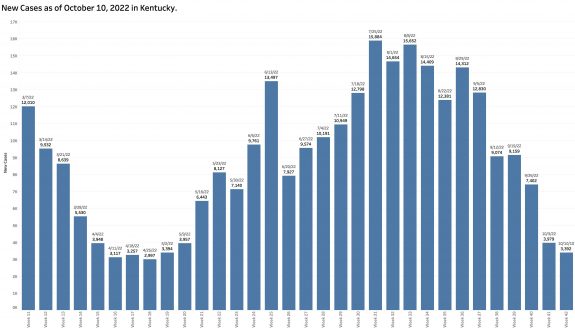

Monday’s October 10th Covid update from the Kentucky Department of Public Health (KYDPH) reports a continuing fall in new cases and in overall state incidence rate. New cases last week (as defined) fell a little further to 3392, the lowest since early last May. The current overall incidence rate of 10.3 per 100K population also decreased to May levels. This is expected because this latter measure of disease activity is derived directly from the number of new cases. For the same reason, the number of Kentucky counties “in the red” for incidence rates fell to four. All of these are clustered in the far southeastern part of the state and show up as a prominent hot-spot on national maps. The statewide test-positivity rate, while up a tad, is also as low as it was last May. Hospitalizations are still going down, but deaths are not.

Nonetheless, a closer look at the report confirms in my mind that the number of new cases acknowledged in the report continues to vastly underestimate the actual number of individuals contracting Covid-19 for reasons I have discussed in the last few articles in this series. It appears to me that there has been a collapse of reported clinical testing and reporting in Kentucky, and likely in other states. We are in my opinion and that of others, “flying blind.”

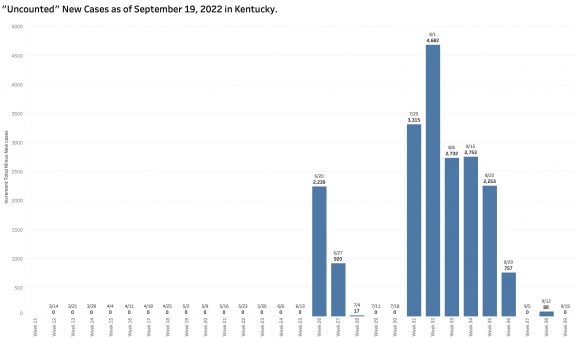

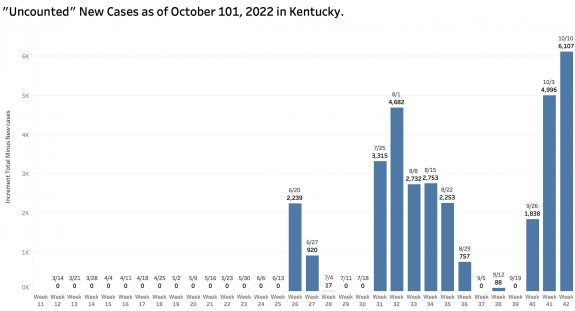

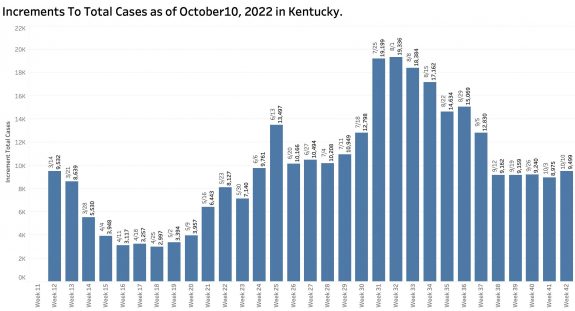

Missing new cases:

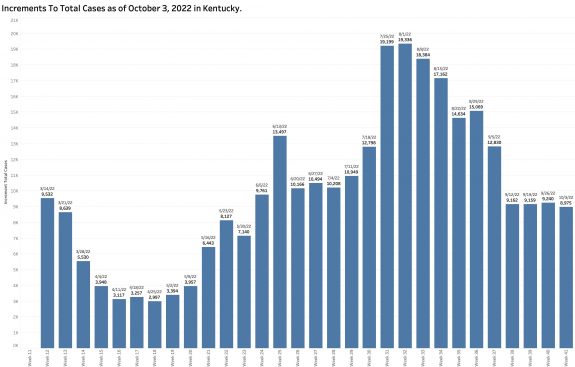

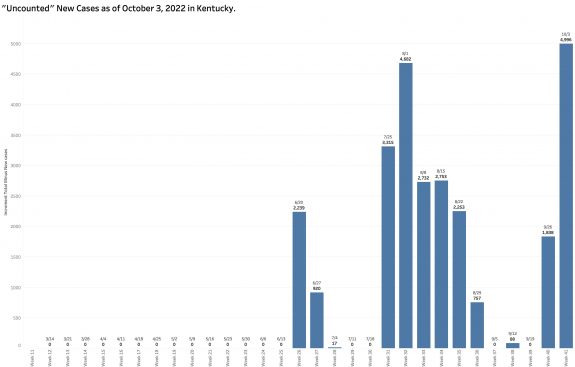

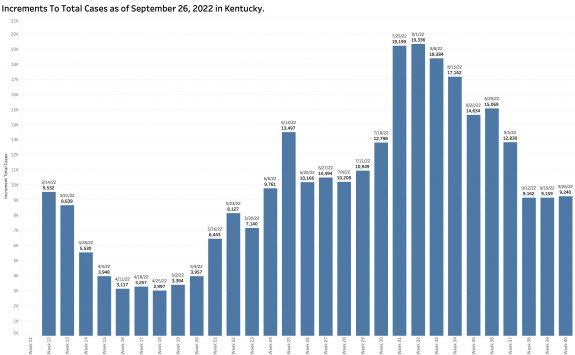

While “new” cases as reported are declining, the additional number of previously unreported cases older than 30 days is soaring. These have been added to the aggregate total number of KY cases since at least last June but not included as “new cases” in the weekly reports. This week’s report adds a record high of 6107 previously uncounted cases to the total. This is nearly double the number of “new” cases in the same report! When these previously unreported cases are included in the weekly increments to total cases, there’s has been no decline in cases over the past 5 weeks.

New Cases Defined:

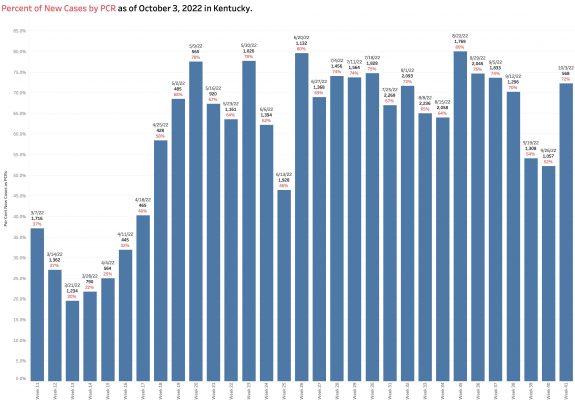

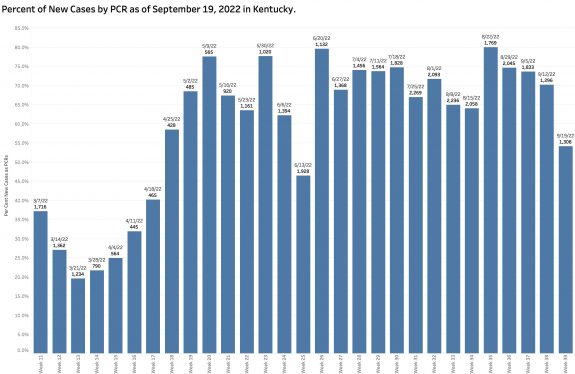

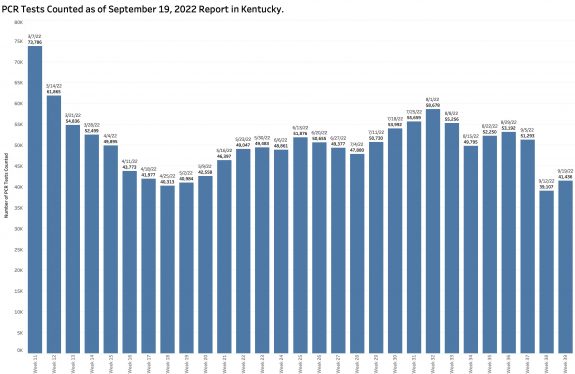

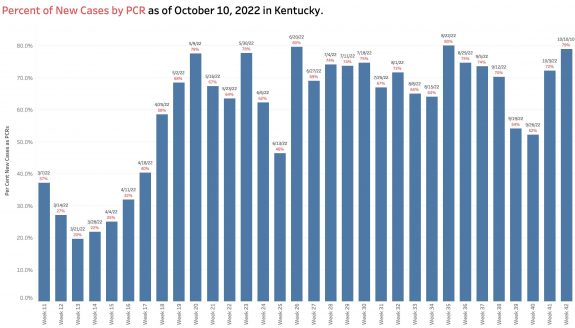

Current “new” cases are derived from a restricted small pool of Kentuckians– largely only those whose viral PCR tests are reported electronically to the state. Antigen tests done at home, in offices, or in schools are presumably disregarded. PCR tests not reported with approved connections, or cases diagnosed clinically are similarly not included. For example, 79% of new cases this week were derived from the reported PCR pool. This is as high a percentage as ever and several multiples higher than in March when weekly reporting was begun.

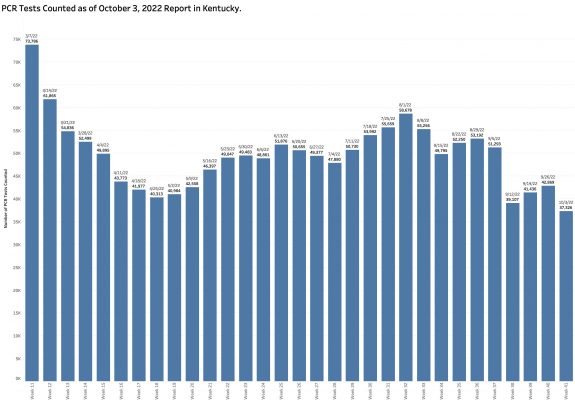

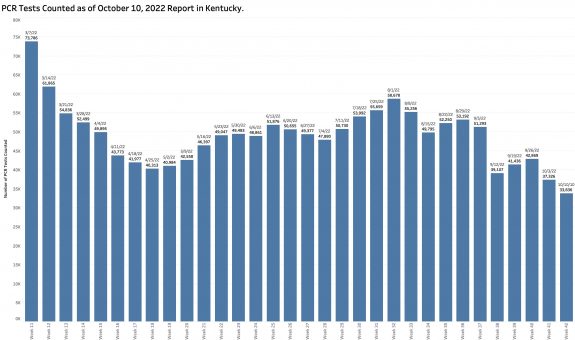

Another factor allowing a new case count to be artifactually low is that the overall number of PCR tests reported electronically is lower than at any point since May and continues to fall. The pool of individuals used as a basis for determination of disease activity is much decreased.

Is Kentucky as a state doing comparatively poorly with its epidemic?

Or is there no way to make a fair comparison any more? I am forced to conclude that the numbers of cases reported directly from the KY Department of Public Health is unreliable. I do not know how the New York Times gets its numbers but their updates were better than the CDC’s for much of the early pandemic and I have always relied on them for national historical comparisons. Yesterday’s NYT updates has KY standing out clearly as having the highest incidence rate per 100K of any state or territory. Of all the counties in the nation, 15 of the 25 with the highest incidence rates are in Kentucky! Something is not computing in my aging mind. What am I missing?

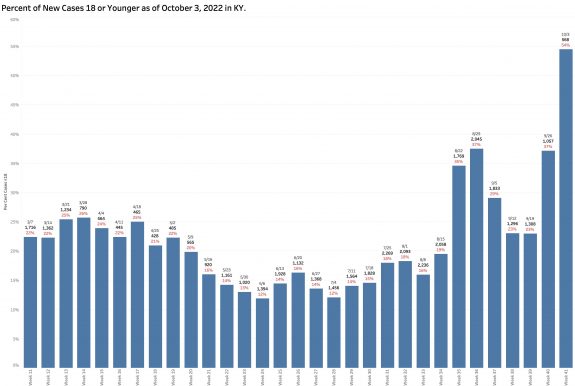

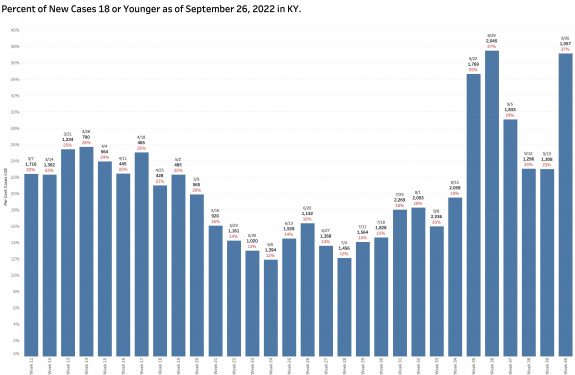

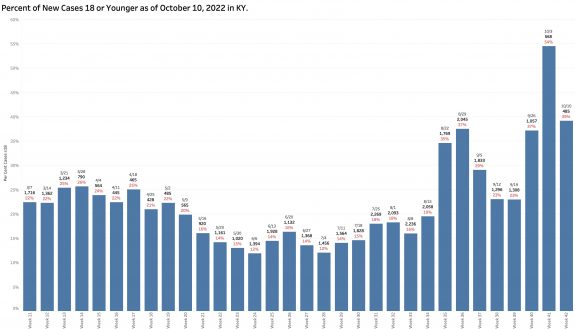

Are school-aged individuals over-represented in case counts?

Of the new cases identified by reportable PCR tests, a large proportion of infected individuals are 18 years old or younger. This week that proportion was 39%. The previous week it was 54%. This proportion has been rising erratically since school began in August. This seems high to me. I am unfamiliar how schools test for and report Covid-19 infections.

Viral RNA in Wastewater- It is everywhere!

Under the direction of Dr. Ted Smith, the Center for Healthy Air Water and Soil at the Christina Lee Brown Evirome Institute at the University of Louisville has been doing important pioneering work examining the amount of Coronavirus RNA in the sewage of Jefferson County. The virus is excreted in the feces of infected people and can be reliably measured. Wastewater SARS-CoV-2 RNA is not a substitute for accurate case counts, but this approach provides a broad overview of the amount of recently active Covid disease in the County. It also identifies the prevailing viral variant, currently Omicron BA.5. In the comprehensive UofL Envirome Institute’s September 2022 report, it looks to me that since January 2021, the levels of viral RNA in wastewater are as high as they have ever been even as reported cases in Louisville have been decreasing.

As we enter the season of respiratory illness, I am reading that the Federal Government will no longer cover the cost of Covid vaccinations or tests. So much for the “public” part of public health. Are we really reverting to our “every-person-for themself” brand of American healthcare in the middle of an epidemic of historic significance? If my interpretations are correct (and I hope to be very wrong), we are headed for another disastrous winter with our heads in the sand.

Respectfully and with trepidation,

Peter Hasselbacher, MD

Emeritus Professor of Medicine, UofL

12 October 2022

Short Link:

http://www.khpi.org/blog/?p=7399